Recently, according to domestic media reports, HiPhi Auto’s parent company, Human Horizons, has reached a comprehensive strategic cooperation agreement with iAuto Group. iAuto will support HiPhi Auto in various aspects of reorganization, facilitating resumption of work and production to restore normal operations.

Under the agreement, iAuto plans to invest more than 1 billion dollars (over 7.2 billion RMB) to support HiPhi Auto’s restructuring plan. The agreement states that this transaction will be completed before the financial report is released in the first half of 2024.

It is reported that the scope of cooperation includes manufacturing collaboration to fulfill sales orders, equity acquisition, technological cooperation, integration of branding and overseas marketing, and integration of supply chain and production. Currently, Human Horizons has begun team reassessment and preparations for the resumption of production. However, HiPhi Auto and Human Horizons have not yet responded to this matter.

It appears that HiPhi Auto might finally be able to make a comeback. But who exactly is this affluent investor, iAuto, that is willing to invest over 1 billion dollars?

Upon further investigation, it turns out that iAuto was originally named Huize Auto and was founded in 2018. It is a company focusing on automotive technology and automotive fintech, with key technologies including low-temperature controlled nuclear fusion variable modules for automotive drives.

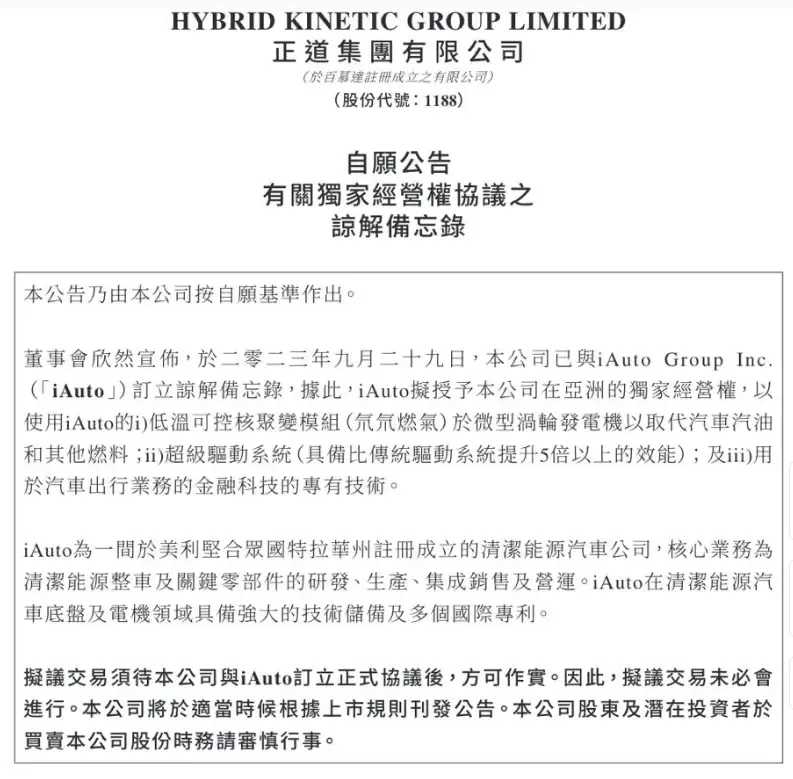

In September 2023, Tianda Group announced a Memorandum of Understanding with iAuto, granting Tianda Group exclusive operating rights in Asia to use several of iAuto’s patented technologies. The ultimate beneficial owner of iAuto is Yung Yeung, the chairman and largest single shareholder of Tianda Group.

Yung Yeung was one of the prominent figures at Brilliance Auto. In October 1992, he was instrumental in getting “Brilliance Auto” listed on the New York Stock Exchange, raising 72 million dollars. In 1999, he also facilitated Brilliance Auto’s listing in Hong Kong.

However, in 2002, due to conflicts with the local government over the Rover Auto project, Yung Yeung sold all of his Brilliance China shares and moved to the United States.

Despite this, Yung Yeung did not give up on his automotive dreams. In 2009, he founded Tianda Group and in 2017, unveiled the first electric concept car H600 at the Geneva Motor Show. This investment in HiPhi Auto through iAuto shows Yung Yeung’s renewed ambition in the automotive sector, now focusing on HiPhi Auto to fulfill his car-making dream.

Yung Yeung is more adept at capital operations, using finance to realize his automotive ambitions. HiPhi Auto, currently in dire need of funds, stands to benefit from Yung Yeung’s investment. His interest lies not only in HiPhi Auto as a company but also in the potential of the Chinese new energy vehicle market, with intentions to return to car manufacturing through HiPhi. Now it remains to be seen whether Yung Yeung and Ding Lei can spark synergy to steer HiPhi back on track.

Summary

Investing over 1 billion dollars might indeed solve HiPhi’s current bankruptcy crisis. However, for HiPhi to truly survive and thrive, it needs to revamp its car manufacturing, new car launch, and sales strategies significantly. Additionally, it must develop its unique technological edge instead of merely selling aesthetics and design.

With the competitiveness of China’s new energy vehicle market now more fierce and brutal than when HiPhi first emerged, most new entrants have fallen by the wayside. HiPhi’s ability to secure funding is fortuitous, and it remains to be seen if the revived HiPhi can make a significant impact in the automotive industry once again.